Show your true colours

Open a new account or renew your card to choose from six different colours that really stand out. Add to your Digital Wallet straight after opening a new account without waiting for your physical card to arrive.

If you can’t find the help you need here, please get in touch

A Newcastle Permanent Visa Debit card offers you convenient and secure access to your own money anywhere where Visa is accepted worldwide. You can use a Visa Debit card online, overseas, over the phone, and through ATMs, eftpos and Visa contactless payments~.

A Visa Debit card allows you to conduct transactions using your own money, while a Visa Credit card provides you with the ability to access money up to an approved credit limit.

A Visa Debit card allows you to make purchases using mobile payments, online and over the phone, as well as providing access to your money overseas. In addition, you also have the added convenience of Visa contactless payments~ and the security of Visa’s Zero Liability policy- .

A Cashcard can only be used through ATMs and eftpos within Australia.

A Newcastle Permanent Visa Debit card or Visa Credit card allows you to access your money anywhere Visa is accepted worldwide online, through ATMs and in-store purchases. When using an ATM or making a purchase overseas ensure you press ‘credit’ to complete the transaction. Fees and charges may apply.

A Cashcard can only be used in Australia. If you are travelling overseas ensure you have upgraded to a Visa Debit card at least 4 weeks prior to your departure.

We recommend that you tell us in advance if you are intending on travelling overseas and using your card.

You will be issued a replacement card within four to six weeks of the card expiring. Your current card will continue to work right up to the last day of the month of its expiration. If you have not received your replacement card within two weeks of its expiry, please call us on 13 19 87.

If you have set up your recurring payment from your digital wallet, no action is required. Otherwise, if your card number has changed, you will need to contact the merchant directly to advise them of your new account number and expiry date for your reoccurring payments to continue.

Due to recent industry changes, merchants have the ability to decide how contactless transactions will be processed. When a merchant chooses to process the transaction via eftpos, you may be subject to an eftpos transaction fee if you have exceeded the number of free ‘everyday transactions’ allowed on your account (refer to your Product Schedule). If you are unsure how your transaction will be processed, you can insert your card into the terminal and select the ‘credit’ option for Visa or the ‘cheque’ or ‘savings’ option for eftpos.

Sometimes a merchant will place a hold on funds in your account to confirm you have sufficient funds to cover the costs of the goods or services (e.g. A hotel may do this at the commencement of your stay). You will not be able to access these funds until the hold is removed, and a transaction for this amount is processed. If you have decided to settle the account by another means or the final transaction amount differed from the initial amount held, the hold may remain on your account for up to 14 days unless cancelled by the merchant.

To have the hold removed earlier, you will need to contact the merchant directly.

You must be 11 years or over to apply for a Visa Debit card (11-13 year olds require parental consent). You can opt to receive a Visa Debit card when opening an eligible new account.

If you wish to upgrade an existing account to a Visa Debit card visit one of our branches or call 13 19 87.

You can apply for a Value+ Credit card if you are 18 years or over, are a permanent citizen or currently reside within Australia, and you earn at least $20,000p.a.

If you answer yes to these questions, you can apply for a Value+ Visa Credit card online. The online application should only take 10-15 minutes to complete, and we should be able to process your application within 5 business days once we have received your documentation.

Once approved, your card should arrive in the mail within 7- 10 working days. You can activate your card and choose a PIN via Internet Banking or the app. If you require a PIN to be mailed to you please contact us on 13 19 87 or visit a branch.

Our Visa cards are embedded with the latest EMV* microchip technology and purchases are protected by Visa’s Zero Liability policy.

When you use Visa contactless~ or select ‘credit’ using your Newcastle Permanent Visa card you also get added protection through our fraud detection system.

You should never allow others to use your card and ensure you always keep security information like passwords and PINs secret. Allowing others access to your card and/or PIN may mean you will be held liable for fraudulent or unauthorised transactions on your card.

It is a good idea to regularly review transactions on your account; you can easily do this via Internet Banking or by contacting us. If you think there might be an unauthorised transaction on your account, contact us immediately.

In Australia:

If your card has been lost or stolen, you can place a temporary block on your card by logging into Internet Banking if you are registered or by calling us on 13 19 87. The temporary block will stop any card related transactions from occurring on the account. If your card is later relocated, the temporary block can be removed. If the card cannot be located or was stolen, you can arrange to have the card cancelled and a new card issued on the account. Your new card will be sent to you via mail and should arrive within 7-10 working days from ordering.

Overseas:

If your Newcastle Permanent Visa card is lost or stolen while you are overseas, contact us immediately to cancel the card by calling +61 2 4907 6501. If required, you may be able to access a replacement card or emergency cash through Visa Global Customer Assistance. These services are 100% discretionary based on your specific circumstances and may not be available in all instances.

To protect yourself when shopping online, visit only trusted merchants and avoid sites which ask you to provide unnecessary information or ask you to send payment information via email. Check to ensure that transactions occur in a secure environment. Any website URL where you enter sensitive payment information should begin with https://.

In the event that you notice any unauthorised transaction on your account, you must notify us immediately by calling 13 19 87 or visiting your local branch. Transactions made using a Visa Debit card or Visa Credit card are protected under Visa’s Zero Liability Policy, meaning you are protected if your card is lost, stolen or fraudulently used, online or offline.

Using Visa contactless payments~ allows you to complete transactions quicker and spend less time at the checkout. Simply use your card to tap to pay at the contactless reader and provided the transaction is below the contactless threshold you won’t be required to enter a PIN. It is not possible for your Visa contactless payments~ enabled card to be accidentally charged, an authentic transaction needs to be initiated in a retail store. In addition to this, throughout a contactless transaction you remain in control of your card, reducing the risk of card skimming and counterfeit fraud – making using Visa payWave~ a safe and convenient way to shop.

Many companies offer products or services with a free trial period. If you are considering one of these offers, we strongly recommend you read the merchant’s terms and conditions so that you know what you are signing up to. Your participation in the trial means you automatically agree to all the terms and conditions, including the automatic charge of the full cost of the product and/or monthly subscription charges once the trial period ends. This may mean you are not able to recover your funds later on.

Free trial periods often begin on the original order date and are usually for a short window time (around 15 days). This means if the product is coming from overseas, you may only have a small window of opportunity to trial it before your account is charged.

It’s important to notify us as soon as possible if you notice any unauthorised transactions or suspicious account activity.

Alternatively, you can notify us on 13 19 87 or by visiting your local branch.

You can also take practical measures to secure your accounts by reducing your payment limit or placing a temporary block on your cards.

Note that if you reduce your payment limit to $0 or block your cards you will need to contact us to increase your limit or unblock your cards.

If you identify a suspicious / unauthorised transaction on your account, and the dispute cannot be resolved by contacting the merchant or service provider directly, we may be able to help you resolve your dispute through Visa’s dispute processes.

To allow us to help you, you must contact us immediately on 13 19 87 or by visiting your local branch as strict time frames for disputes apply. In order for us to process the dispute, you will need to block your card, and provide us with all the available information and supporting documentation regarding the transaction. It is important to note there are set rules and timeframes for the dispute processes, which can sometimes take up to 180 days to resolve.

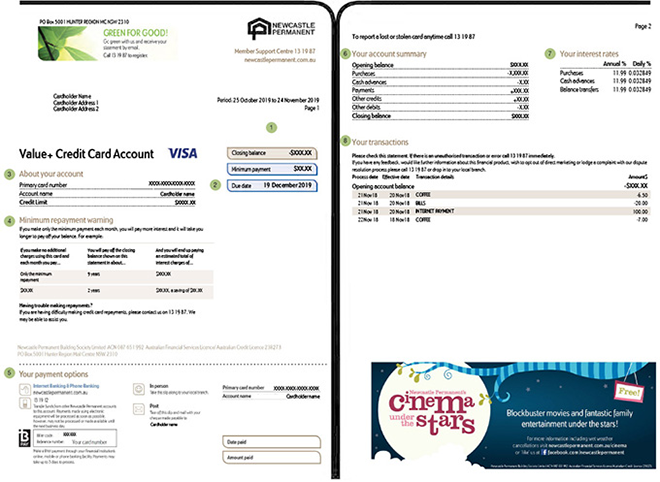

Interest is calculated daily based on the balance owing on your account, and is charged once a month. Different interest rates may apply for different types of transactions, such as purchases, balance transfers and cash advances. An interest-free period may apply on some purchases where you pay the closing balance in full by the due date.

Download our Interest facts for Value+ Credit Card PDF for more information.

Purchases made on your credit card may be eligible for an interest-free period. The amount of interest-free days available will depend on the day on which you make the purchase within your statement cycle.

For purchase transactions to be eligible for an interest-free period, the closing balance on your previous statement must have been paid in full by it's due date.

If you do not pay the closing balance in full by the due date, interest will be charged on the remaining balance and any new purchases until the closing balance is paid in full.

A great way of ensuring your credit card payment is made each month is to set up an automatic payment. You can choose from paying the full balance owing, the minimum repayment amount, or a nominated fixed amount. This can be set up via our internet banking, by calling us on 13 19 87 or by visiting a branch.

You can also make repayments by BPAY®, post or in person by visiting your local branch.

Some payments (including automatic transfers and BPAY) may take a few days to process, so please ensure you have left enough time to meet your payment due date.

Use internet banking to set up an automatic payment from another account to your Value+ Credit Card. You can nominate to make:

Internet banking:

To cancel and close your Value+ Credit Card:

To cancel and close your Business+ Credit Card, contact us, visit your local branch, or contact your Business Relationship Manager.

To change your facility limit or a card limit for Business+ Credit Cards, contact us, visit your local branch, or contact your Business Relationship Manager.

To change your facility limit or a card limit for Business+ Credit Cards, contact us, visit your local branch, or contact your Business Relationship Manager.

A balance transfer involves moving the balance or part of a balance from one or more credit cards over to another. Consolidating your credit card debt can help make it easier to manage by lowering your fees or the interest rate you are being charged.

You can request a balance transfer from another financial institution to Newcastle Permanent. If your application is successful, we'll process your transfer request once you receive and activate your card.

Transfers can take up to 10 business days and you will need to keep making payments to your other account until the transfer is complete. You'll be charged interest on the balance transfer amount from the date it is completed.

Requesting a balance transfer does not cancel your old card. To avoid accruing more debt, consider cancelling your old card by calling your provider once the transfer is complete.

Too much paper? Switch to E-statements now. You can elect to receive statements electronically by calling us on 13 19 87, visiting a branch or sending us a secure message through Internet Banking. Once registered, you will be notified by email when a new statement is available to view in Internet Banking.

The below lists the key things you need to know to read your credit card statement.

Other things to look out for. You may also find messages from us on your statement from time to time to tell you about important changes to your credit card, such as changes to interest rates.

You should consider the Terms and Conditions. Fees and charges may apply.

-For more information on Visa services such as Visa’s Zero Liability policy, Visa contactless payments, Visa Checkout and Verified by Visa, visit www.visa.com.au, drop into your local branch or call 13 19 87.

*‘EMV’ stands for ‘Europay, Mastercard and Visa’. EMV chips are a global standard initiative used to help authenticate credit card and debit card transactions conducted through ATMs and eftpos systems.

Apple Pay Terms of Use.

Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iPad, iPhone, iTunes, Mac, MacBook Pro, Safari, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries and regions. *For a list of compatible Apple Pay devices, see support.apple.com/en-us/HT208531. Cashcards and Business+ Credit Cards are not eligible.

Google Pay Terms of Use.

Google, Google Pay, Android, Google Wallet, Google Play and the Google Play logo are trademarks of Google LLC. Cashcards and Business+ Credit Cards are not eligible.