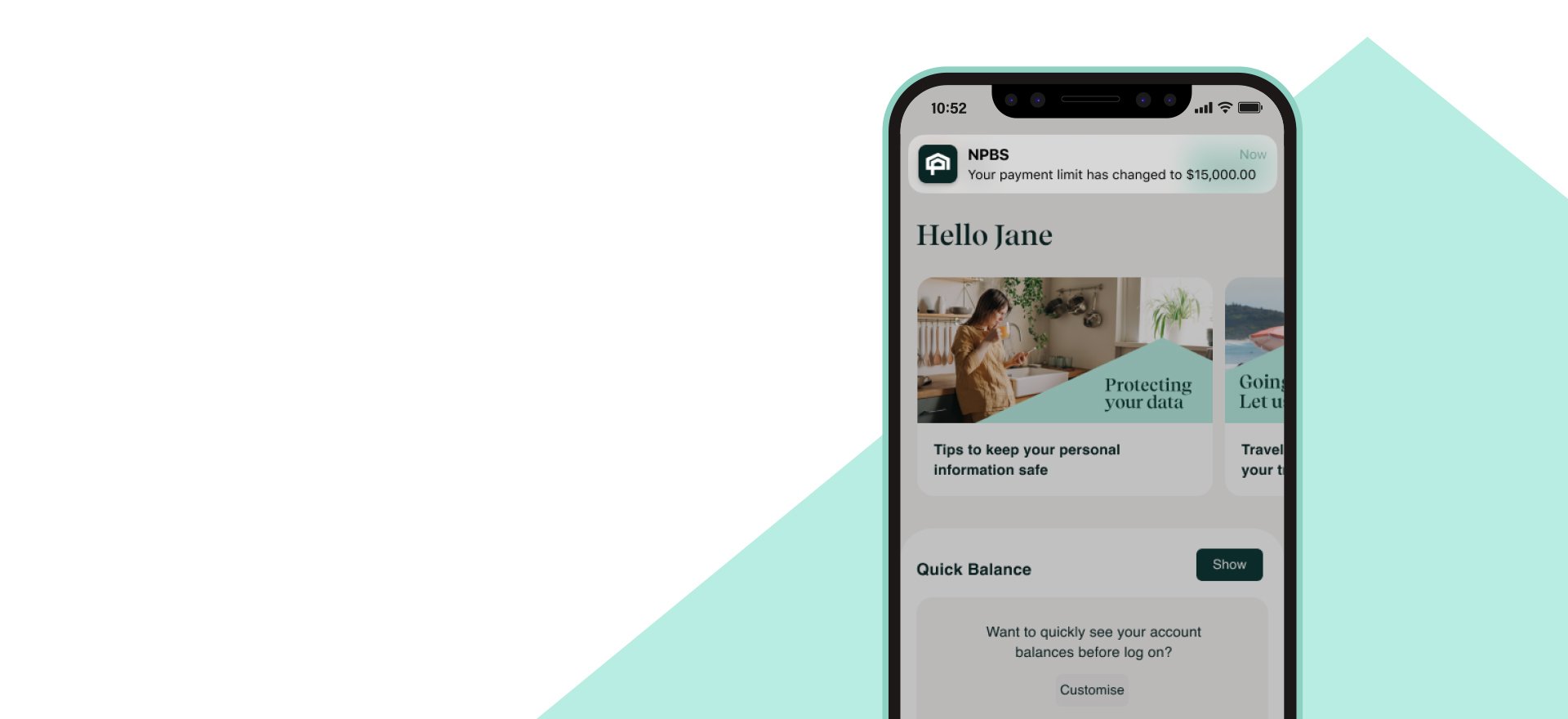

Smart. Simple. Secure.

A smart and secure app that gives you easy access to your money? That's not bad. And it's packed full of enhancements to give you great banking today and into the future.

Take control of your finances and open an account in seconds, see where your money is going with our detailed transaction listing, manage your personal information and make payments in an instant.

Download it now from the App Store and Google Play™.

App features

Personalised for you

Rename and reorder your accounts.

Safe and secure

Log in with facial recognition, fingerprint or secure passcode.

Easy payments

Transfer cash in an instant and add eligible cards to Wallet.

Account management

Open an account in seconds and manage your cards.

FAQs

Multi-factor authentication (MFA) is automatically applied to our app. When you log on using your passcode or biometrics, we run additional authentication checks in the background to help keep you safe and protected.

MFA is also available for internet banking. By opting in, we’ll send you a one-time password via SMS each time you log in for an extra layer of security.

Internet banking

- Log on

- Go to Settings > Security > Log on security

- Click Enable

- Enter one-time password

- MFA is now enabled.

Push notifications are an easy way to receive updates and important information about your accounts. If you’re creating a profile or downloading the app for the first time, you’ll be prompted to allow notifications during the set-up process. Otherwise, you can easily switch them on using your phone settings. Once you’ve enabled push notifications, you’ll get alerts sent directly to your device and you can manage your preferences at any time.

iOS:

- Open the Settings app on your phone.

- Select ‘Notifications’ and tap Newcastle Permanent

- Tap the ‘Allow notifications’ toggle button on

- Log on to the app.

- Customise your settings by navigating to Profile > Settings > Notification settings.

Android:

- Open the Setting app on your phone.

- Select Notifications and tap App notifications.

- Tap the Newcastle Permanent toggle button on

- Log on to the app.

- Customise your settings by navigating to Profile > Settings > Notification settings.

If you need to change your details, you can update your email address, residential address or mobile phone number yourself via the app or internet banking.

App:

- Log on to the app,

- Tap 'Profile' from the home screen menu

- Tap 'Contact details' and follow the prompts.

To update your new number for PayID® separately, select ‘PayID’ from the Profile screen, delete your old PayID and add a new one. Remind your friends and family to use your new number the next time they make a payment to you.

Internet banking:

- Log on

- Navigate to Settings > Update my details and select the contact method you want to change

- Follow the prompts.

Alternatively, visit your local branch or call us on 13 19 87.

Your password should contain a unique combination of upper and lower-case letters, numbers and special characters. Don’t use common dictionary words or personal details like your name, Customer ID or date of birth, otherwise you could be liable for any unauthorised transactions. You’ll be able to see a password strength indicator the first time you register via the app or when you change your password through internet banking.

Log on to the app and select ‘Profile’ from the bottom menu to find your 8 digit Customer ID. Otherwise select ‘Forgot Customer ID’ from internet banking and follow the prompts.

We recommend updating to the latest version of the app as soon as it's available for the best possible experience and to take advantage of any functionality or security enhancements.

To manage the devices you’re logged in on, log on to the app, tap ‘Profile’ from the home screen menu then tap ‘Security’ then ‘Manage Devices’. All devices that you have used will appear, select any you wish to remove.

To set up a separate profile:

- Tap the icon in the top left of the log in screen and select ‘Add new profile’

- For a personal profile, select the ‘Personal’ button at the top of the screen

- If your new profile is for your business, select the ‘Business’ button

- Enter your details to complete set up

To toggle between your registered profiles, select the icon in the top left of the log in screen and choose which profile you’d like to use.

Access your accounts

You may need to access your accounts from overseas, so make sure you know your app or internet banking password before you go.

Please contact us before you go to set up an alternative Transaction Password to use while travelling, this will ensure you can continue to access your accounts avoiding any issues overseas accessing your Australian mobile number to receive your SMS one-time password.

Notify us of your travel plans

Let us know your travel plans via the app or internet banking banking so we can monitor your account activity overseas and provide better security for you.

To use the app to notify us of your travel plans:

- Log on

- Go to Profile

- Select Overseas travel and follow the prompts.

To use internet banking to notify us of your travel plans:

- Log on to internet banking and navigate to Services > Overseas travel,

- Select 'Add trip'

- Enter all countries you plan to visit including stopovers, and the dates you are travelling,

- Use the checkboxes provided to let us know if you are planning to use your cards for ATM withdrawals, or for large purchases,

- Select ‘Save’.

Alternatively, you can call us on 13 19 87, or visit one of our branches to notify us.

Security advice

Your bank will never contact you unexpectedly and request the following:

• Share your password, PIN, customer number, or one-time password

• Transfer money, withdraw, or deposit cash to a third party

• Click a link to grant access to your computer

• Send a courier or staff to pick up money, cards, or details from you.

Never respond if you're contacted unexpectedly and asked for any of the above. Rather call your bank directly or visit your local branch to confirm if it's a legitimate request.

Going overseas? Let us know in the app

Notify us of your travel plans via the app or internet banking so we can help keep an eye on your account activity while you're away.

Get in touch

Make an enquiry

Get in touch with us online, and we'll get back to you as soon as possible.

Visit your branch

Find the Newcastle Permanent branch that's closest to you.

Terms and conditions apply for internet banking and the banking app.

Apple Pay Terms of Use.

Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iPad, iPhone, iTunes, Mac, MacBook Pro, Safari, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries and regions. *For a list of compatible Apple Pay devices, see support.apple.com/en-us/HT208531. Cashcards and Business+ Credit Cards are not eligible.

Google Pay Terms of Use.

Google, Google Pay, Android, Google Wallet, Google Play and the Google Play logo are trademarks of Google LLC. Cashcards and Business+ Credit Cards are not eligible.

PayID and PayTo are registered trademarks of NPP Australia Limited.